Car Accident Insurance Claim Process

Car accidents are more than just a momentary shock; they are the beginning of a complex legal and financial journey. If you’ve been involved in a collision in the United States, understanding the mechanics of car accident insurance claims is the only way to ensure you aren’t left paying for someone else’s mistake.

In this guide, we will break down the “Black Box” of insurance claims, from the different types of coverage to the secret tactics adjusters use to devalue your case.

Before you start your paperwork, ensure you have followed the immediate safety and evidence-gathering steps in our guide on what to do after a car accident in the United States.

Inside This Essential Insurance Guide

Understanding the Core of US Insurance Claims

An insurance claim is a formal contract-based request. You are essentially notifying an insurance company that an event occurred which triggers their obligation to pay. In the U.S., these claims are the primary way victims recover money for medical bills, vehicle repairs, and “Pain and Suffering.” To master the car accident insurance claim process, you must first understand your rights. You can review the official consumer guide to auto insurance provided by the NAIC.

Why Precision Matters

The moment you file a claim, a “Claim Number” is generated. Every word you say to an adjuster from this point forward is recorded. Mistakes early in the car accident insurance claim process can be used to reduce your payout, which is why preparation is vital.

The 4 Pillars of Auto Insurance Coverage

To navigate a claim, you must know which “pocket” the money is coming from. Most U.S. policies are split into specific parts that dictate how the car accident insurance claim process unfolds:

- Liability Insurance (The “Other Person’s” Protection): This covers damage you cause. If you are hit by someone else, you are making a claim against their liability policy. Fact: Most states require a minimum (e.g., 25/50/25), but this often isn’t enough for major crashes.

- Collision Insurance: This pays for your car’s repairs regardless of fault. If the other driver is uninsured, this is often your only way to fix your vehicle.

- Personal Injury Protection (PIP) / MedPay: This is “No-Fault” coverage. It pays for your ER visits and X-rays immediately, even if the accident was your fault.

- Uninsured/Underinsured Motorist (UM/UIM): Protects you if the other driver lacks insurance. Check the latest US insurance claim facts and statistics to see how these coverage types impact national settlement averages.

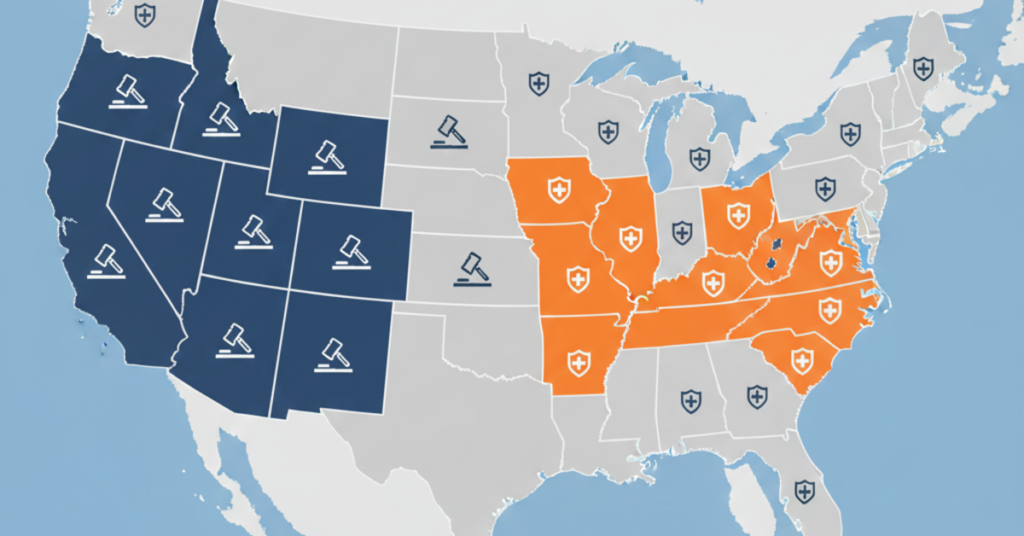

The “Fault” Divide: Tort vs. No-Fault States

One of the biggest factors in the car accident insurance claim process is your state’s laws.

Tort (At-Fault) States

In states like California, Texas, or Illinois, the person who caused the accident is responsible for the bills. You must prove negligence to get paid.

No-Fault States

In states like Florida, New York, and Michigan, your own insurance pays for your medical bills (via PIP) regardless of who hit whom. You can usually only sue the other driver if your injuries are “Permanent” or exceed a specific dollar “Threshold.”

Step-by-Step: Navigating the Claim Lifecycle

Phase 1: The Scene and Initial Filing

- Prompt Reporting: Delaying your report gives the insurer a reason to suspect fraud and can stall the car accident insurance claim process.

- The “No-Apology” Rule: In the U.S., saying “I’m sorry” can be legally interpreted as an admission of fault. Stick to the facts.

Phase 2: The Adjuster’s Investigation

Once the claim is open, an Insurance Adjuster is assigned to verify coverage, liability, and damages. Their role is central to the car accident insurance claim process.

- Coverage: Was the policy active?

- Liability: Who caused the crash?

- Damages: Is the repair quote reasonable?

Phase 3: The Assessment and “Total Loss”

If your repair costs exceed a certain percentage of your car’s value (usually 70%–80%), the insurer will “Total” the car. You will be offered the Actual Cash Value (ACV)—not what you paid for the car, but what it’s worth today.

2026 Settlement Estimates: What is Your Claim Worth?

Knowing what to expect is the most important part of the car accident insurance claim process. Insurance companies often use “Multipliers” (1.5x to 5x) to calculate pain and suffering.

| Injury Category | Typical Settlement Range | Typical Duration |

| Minor (Whiplash/Soft Tissue) | $5,000 – $25,000 | 2–4 Months |

| Moderate (Broken Bones/Surgery) | $30,000 – $100,000 | 6–10 Months |

| Severe (Spinal/Brain Injury) | $250,000 – $1M+ | 12–24 Months |

Common Challenges & “Trap” Tactics

Insurers are businesses, not charities. To protect your payout during the car accident insurance claim process, watch out for these:

- The “Low-Ball” First Offer: Insurers often offer a check within 48 hours. Warning: If you take it, you lose the right to ask for more money later if your pain gets worse.

- The “Recorded Statement” Trap: They will ask to record your side of the story. You are NOT legally required to do this for the other driver’s insurance.

- Comparative Negligence: In many states, if you are 20% at fault, your check is cut by 20%. Adjusters will try to find any small reason to put some blame on you.

Crucial Documents Checklist

To maximize your payout in the car accident insurance claim process, you need a “Paper Trail”:

- Official Police Accident Report (The “Gold Standard” of evidence).

- Medical Treatment Records: Every doctor’s visit, physical therapy session, and prescription receipt.

- Proof of Lost Wages: A letter from your employer showing the hours and pay you missed.

- The “Pain Diary”: A daily log of how your injuries limit your life (e.g., “Could not pick up my child today due to back pain”).

Frequently Asked Questions (FAQ)

Q: What if the other driver’s insurance calls me?

A: Be polite but brief. Provide your name and vehicle info, but do not discuss your injuries or the details of the crash until you’ve spoken to your own agent or a lawyer.

Q: Can I choose my own repair shop?

A: Yes. In most U.S. states, you have the legal right to choose where your car is fixed, though the insurer may only pay what they deem “reasonable.”

Q: What is a “Deductible”?

A: It is your out-of-pocket cost. If you have a $500 deductible and $2,000 in damage, the insurer sends you $1,500.

Q: How long does the car accident insurance claim process take?

A: It varies by state and injury severity, but most simple vehicle damage claims are settled within 30 days, while injury claims can take months.

Conclusion: Don’t Settle for Less

A successful car accident insurance claim process is a battle of documentation. By being the most organized person in the room, you force the insurance company to take your claim seriously. Remember: Report early, document everything, and never sign a final release until you are 100% healed.

Contact Us

Do you have a complex claim or a disputed fault? Don’t fight the billionaires alone. Fill out our contact form for a free strategy session with an expert.